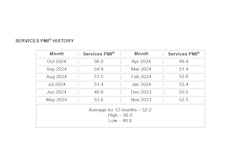

The Services Purchasing Manager's Index (PMI) was down for November, following an increase in October. The index remains above 50%, which means the economy is in a state of expansion.

The Institute for Supply Management (ISM) Services Report on Business, issued by the Institute for Supply Chain Management (ISM), measures economic growth and sentiment based upon surveys with industry executives in the services sector, which includes construction. A reading higher than 49 means the economy is expanding.

“Federal Reserve interest rate cuts have not had the desired effect on mortgage rates yet. With election results mostly determined, expansion of residential construction is anticipated, but the unknown effect of tariffs clouds the future," a construction executive reported in the survey.

“Construction materials are shorted or hard to get due to increased construction projects in the area and (in the) U.S. Sometimes projects are delayed due to this," an executive in the public administration industry reported.

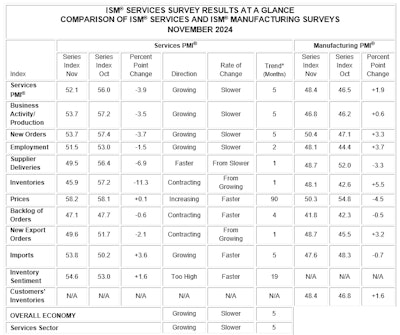

“In November, the Services PMI registered 52.1%, 3.9 percentage points lower than October’s figure of 56%," said Steve Miller, chair of the ISM Services Business Survey Committee. "The reading in November marked the ninth time the composite index has been in expansion territory this year. The Business Activity Index registered 53.7% in November, 3.5 percentage points lower than the 57.2% recorded in October, indicating a fifth month of expansion after a contraction in June. The New Orders Index also recorded a reading of 53.7% in November, 3.7 percentage points lower than October’s figure of 57.4%. The Employment Index landed in expansion territory for the fourth time in five months; the reading of 51.5% is a 1.5-percentage point decrease compared to the 53% recorded in October.

Other key takeaways include:

- The Supplier Deliveries Index registered 49.5%, 6.9 percentage points lower than the 56.4% recorded in October. The index was in contraction territory for the sixth time in 2024 — indicating faster supplier delivery performance — after two months in expansion or ‘slower’ territory. Supplier Deliveries is the only ISM Report On Business index that is inversed; a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases.

- The Prices Index registered 58.2% in November, a 0.1-percentage point increase from October’s reading of 58.1%.

- The Inventories Index returned to contraction territory in November after three months in expansion, registering 45.9%, a decrease of 11.3 percentage points from October’s figure of 57.2%. The Inventory Sentiment Index expanded for the 19th consecutive month, registering 54.6%, up 1.6 percentage points from October’s reading of 53%. The Backlog of Orders Index remained in contraction territory for a fourth consecutive month, registering 47.1% in November, a 0.6-percentage point decrease from the October reading of 47.7%.

- 14 industries reported growth in November, matching the previous month’s total. The Services PMI has expanded in 21 of the last 23 months dating back to January 2023, and the November reading is 0.2 percentage point below its average of 52.3 percent for 2024.”

“The decrease in the Services PMI in November was driven by decreases in each of the four directly impacting subindexes (Business Activity, New Orders, Employment and Supplier Deliveries)," Miller said. "However, 14 industries reported business activity growth, and 13 indicated new orders expansion; both figures are improvements compared to October. This reinforces the view over the last several months that the services sector has returned to sustained growth. Generally, respondents’ comments were neutral to positive, and both positive and negative impacts were attributed to seasonality. Not surprisingly, election ramifications and tariffs were mentioned often, with cautionary outlooks related to the potential impact on respondents’ specific industries.”

The 14 services industries reporting growth in November — listed in order — are: accommodation and food services; arts, entertainment and recreation; health care and social assistance; wholesale trade; agriculture, forestry, fishing and hunting; public administration; finance and insurance; management of companies and support services; retail trade; transportation and warehousing; information; professional, scientific and technical services; construction; and utilities. The three industries reporting a contraction in the month of November are: mining; real estate, rental and leasing; and educational services .

For November commodities, the following were up in price: aluminum products; diesel fuel (both up and down in price); electrical components; labor (48); labor — skilled; lumber (3); maintenance services; and propane. Commodities down in price were: computers; diesel fuel (2); fuel (3); and steel products. Commodities in short supply included: appliances; construction contractors (2); electrical equipment (6); IV irrigation; IV solutions (2); switchgear; and transformers (6). Numbers in parentheses note the number of months the commodity has been in that category.