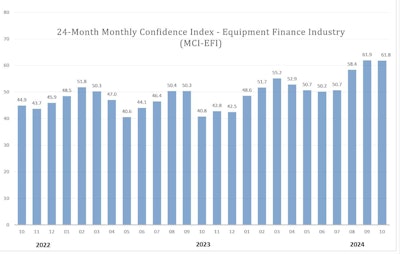

The Equipment Leasing & Finance Foundation released its October 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). At first glance, the index reading is roughly the same as it was for September. Slightly out of the ordinary, and a bright spot, is that the index reading is elevated enough that it is the highest reading since January 2022. The index was at 61.8 for October, steady with the September index of 61.9, which was the highest level since January 2022.

Granted, the Federal Reserve cut interest rates. With the presidential election, though, many leaders in the business world have been hesitant about making purchase decisions before knowing the priorities of the next U.S. leader (and potential Congressional picks), or what direction the economy will likely head.

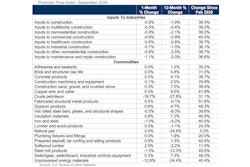

Economic indicator report after report have predicted a positive future for the economy, despite some layoffs and cut backs from a few major players in manufacturing and business. Material prices have dampened the construction industry backlog. These mixed signals make it interesting to watch how the economy in the heavy equipment and construction sectors adapts to the shifting economy and business world.

The foundation's October 2024 Monthly Confidence Index for the Equipment Finance Industry assesses business conditions and expectations based on input from leaders in the $1 trillion equipment finance industry. Some takeaways from this latest report include:

- Business conditions: 37.9% of executives expect improvement over the next four months, down from 40% in September, while 51.7% expect stability.

- Demand for capital expenditures (CapEx): 44.8% expect demand for leases and loans to increase, slightly up from 44% in September.

- Access to capital: 27.6% expect greater access to capital for equipment acquisitions, up from 24%.

- Hiring: 24.1% plan to hire more employees, up from 20% in September.

- U.S. economy: 37.9% believe economic conditions will improve over the next six months, up from 24%.

It's usually illuminating to hear how the leaders responded to the survey for this index. Here are some highlights:

- “With the upcoming election close and the Fed starting the cycle of rate cuts, the uncertainty around these specific concerns will lessen. I think this will help business get back to work solving their customers’ problems and increase investment in capital equipment. Additionally, equipment finance companies, specifically within the bank segment, have unfrozen and are actively investing in the equipment finance sector providing needed access to capital at more attractive rates.” David Normandin, president and CEO, Wintrust Specialty Finance

- “Lower interest rates will ignite CapEx for smaller companies that have been on the sidelines for a few years and need to add or replace equipment for growth. Getting past the election should provide some clarity on the economic direction of the U.S., thus more CapEx investments can be made. Lastly, onshoring will continue to promote infrastructure investment which requires CapEx spending to execute.” Jeffry Elliott, president, Huntington Equipment Finance

- “The Fed’s intent to lower interest rates combined with stabilizing of inflation will stimulate investment, spending and expansion.” Jim DeFrank, EVP and COO, Isuzu Finance of America, Inc.